Knowledge Center

18 Results

-

Cost Savings and Efficiencies Gained with Prefabricated Bathroom Pods – (read more)

Labor shortages and rising costs are reshaping construction in 2025, but there’s a smarter way forward. Prefabricated bathroom pods are helping general contractors and owners overcome workforce challenges, accelerate schedules, and reduce risk. SurePods’ off-site manufacturing approach delivers.

-

SurePods Streamlining Healthcare Construction at AdventHealth Minneola Hospital – (read more)

Learn how critical decisions during the design-assist phase of the AdventHealth Minneola project enabled the smooth integration of prefabricated bathroom pods on site, delivering all 80 pods in a 4-day span.

-

Hispanic Heritage Month Spotlight: Daniela Caraballo – (read more)

This Hispanic Heritage Month, we’re proud to share Daniela’s journey in construction and prefabrication at SurePods. From her Venezuelan roots to her leadership in quality and innovation, Daniela shares how her heritage has shaped her journey and how she’s opening doors for others.

-

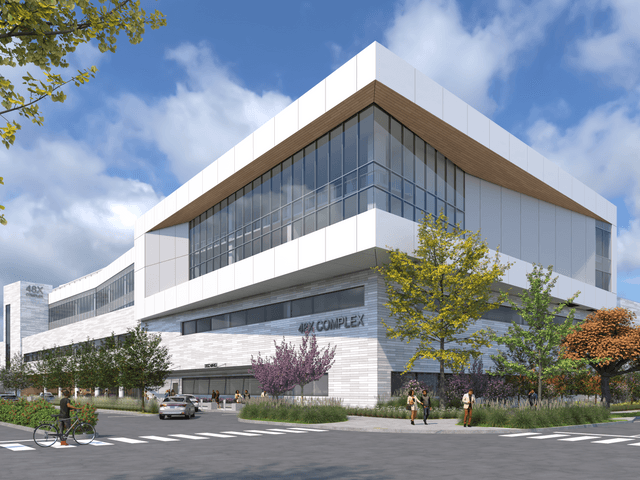

From Design to Delivery in Record Time: UC Davis Health 48X Complex Prefab Bathroom Pod Approach – (read more)

Hear from SmithGroup and SurePods on how implementing prefabricated bathroom pods helped accelerate this fast-paced project.

-

A Prefabrication Success Story at the UTampa Grand Center – (read more)

Using prefabricated bathroom pods for the construction of the University of Tampa (UTampa) Grand Center, their largest project to date, was a critical piece in executing the construction schedule to meet the rising demand of student housing options on campus.

-

Case Study: Meeting Hospitality Construction Demands with Prefabricated Bathrooms – (read more)

The nine-story, 375-room Hotel Polaris at the U.S. Air Force Academy in Colorado Springs highlighted the successful implementation of prefabrication solutions, such as modular bathroom pods, in the face of conventional yet complex challenges of large-scale hospitality projects.

-

Case Study: Driving Innovation in Healthcare – (read more)

Case study on standardization and using prefabricated bathroom pods on the Atrium Health project.

-

SurePods Healthcare Construction 101: Delivery of Pods – (read more)

Learn the basics about pod delivery from the SurePods delivery crew.

-

SurePods Healthcare Construction 101: Floor Conditions – (read more)

Take a deeper dive on how floor conditions are key to successful bathroom pod installation in healthcare settings.

-

SurePods' Award-Winning Safety – (read more)

SurePods’ Phoenix facility received Liberty Mutual’s Gold Safety Award in 2023 for achieving a “DART Rate 100% Better Than the Industry Average”.

-

Prefabrication Gaining Popularity Amongst Builders – (read more)

SurePods was recently mentioned in an Engineering News-Record article, "Contractors Make a Bet on Prefab and Modular", which explores the promise, value, and challenges of building off-site.

-

Case Study: Banner Desert Epoxy Flooring Benefits – (read more)

Bathroom flooring is one of the vital scopes to maintaining proper infection control in healthcare environments. The team at Banner Desert discusses how to achieve infection control standards in bathroom pods by applying epoxy flooring.

-

Case Study: Banner Desert Mockups Help to Increase Efficiency – (read more)

Brittany Burbes of DPR Construction connects with individuals from Banner Health and Cunningham Architects to discuss the use of mockups to increase efficiency of installation and meet the project schedule.

-

Case Study: 20 Mass Project – (read more)

DPR Construction and The RMR Group discuss the benefits of installing SurePods on the 20 Mass project in Washington D.C.

-

Building Momentum for Prefabrication in California – (read more)

SurePods’ approval by HCAI for healthcare facilities in the Golden State marks a milestone for expanding prefabrication capabilities that support all projects.

-

Standardizing Healthcare Facilities with Bathroom Pods – (read more)

Prefabricated, modular bathroom pods are revolutionizing healthcare construction by providing a standardized and cost-effective solution. Read about how SurePods products benefit all stakeholders, from architects to end-users.

-

What’s Ahead for Modular Bathrooms in 2022? – (read more)

As the global market for modular construction continues its upward trajectory, experts predict growth will persist through 2028 due to its ability to streamline building processes and address labor shortages and supply chain issues.

-

Getting to Know SurePods West Business Unit Leader – (read more)

Matt Gaskin, Business Unit Leader at SurePods West, discusses the impact of the new Phoenix-based facility on the prefabricated bathroom pod industry. He also highlights the benefits of local production, including reduced shipping costs, compliance with regional construction challenges, and improved project efficiency, making modular bathrooms a progressive solution for the West Coast construction market.